“The fact that their scheme might bankrupt innocent men, destroy commerce, ruin the country’s standing in the world credit markets, and cover themselves with scandal never entered the conversation”.

– The Gold Ring

A small clique of speculators, industrialists, and bankers, aided and abetted by a few Washington insiders and a smattering of politicians, attempted to control the gold market.

Sound familiar?

It happened….and….furthermore, to this day no one has ever claimed otherwise.

The following potted history draws partly on the historical research of Kenneth D. Ackerman, in The Gold Ring. This work was published in 1988 and is just about to be re-released (see here). Ackerman has produced a splendid page-turner, that kept me spellbound and sleep-deprived for a week as I eagerly devoured it by flashlight in my tent in the bush, while doing geological fieldwork. I give it my highest recommendation.

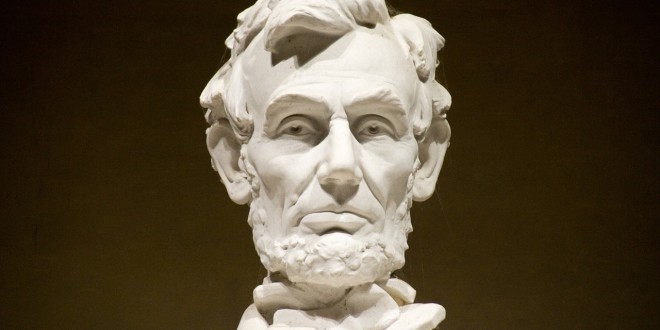

In 1862, Honest Abe took the United States off the gold standard for the third time in US history (the Continental Congress had done it, and so had the administration during the War of 1812…but that’s another story). The War Between the States was going badly for the Union. As the current administration in office is learning, war is a spendy business – feeding and equipping troops, buying armaments and ammunition, transporting materials to and fro – it all costs lots of money. In those days before today’s punitive income taxes were introduced, the Federal Government subsisted largely on income from customs and excise duties. With the seceding of the Confederacy, all that cash from the importation of goods bought with revenues from cotton exports was effectively gone. This was the cash that had financed those colonnaded antebellum mansions in the deep South.

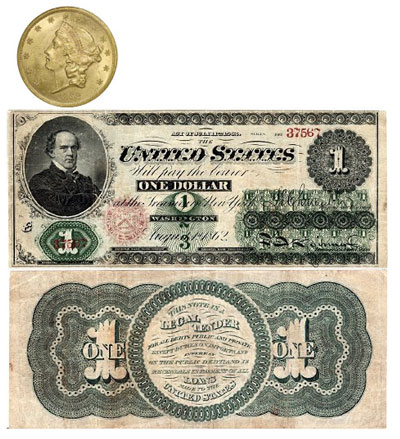

On the brink of bankruptcy and pressed to finance the war, Abraham Lincoln had in 1861 introduced the first non-interest bearing federal paper since the War of Independence. These treasury notes – “demand notes” as they were called – like the later gold and silver certificates – were redeemable in coin from the US Treasury. A design in green ink was printed on the back of each note and in a short matter of time the notes came to be known as “Greenbacks”. No doubt the idea of the notes at the time was to maintain a fractional gold reserve system, based on the unlikelihood of sudden demands for gold by large numbers of note holders. In this way the currency could be inflated to pay for the war. However, as confidence in the ability of the government to redeem the notes started to erode with each victory by Gen. Robert E. Lee, and it became obvious that a run on the bank was indeed possible if not probable, drastic action was necessary and in 1862 the notes were changed to say:

“This note is a legal tender for all debts public and private except duties on imports and interest on the public debt and is receivable in payment of all loans made to the United States”.

This currency – not redeemable in gold – was a fiat currency, backed up by essentially nothing but promises. US Treasury bondholders were to be paid their interest in gold – this was an important guarantee to foreigners holding US debt – and like today, most debt was foreign held. It was important that foreign banks like Rothschilds continued to buy US debt to finance the war. Duties on imports were also to be paid in gold – in reality foreigners distrusted greenbacks and so import purchases had to be paid for with gold coin as they always had. The Federal Gov’t was just making sure it was getting access to physical gold by taxing importers. The US Mint continued to coin gold from domestic gold mine supply, but it was kept aside for Treasury transactions, and rarely got into the pockets of the people.

The fledgling Confederacy also issued paper notes to be “redeemed with gold when hostilities were suspended”. These notes, commonly known as “Confederate Money” were issued by the individual states and by the Confederacy itself. Soon after Lee’s surrender at Appomattox these notes became worthless and became the butt of a century’s worth of jokes.

Once the Greenback was officially declared domestic money, the door was opened for trade in gold, and the gold price was quoted in Greenbacks in all financial districts of major US cities. The Greenback was discounted to gold and always remained so until January, 1879 when the US Currency was returned to the gold standard. Rather than being posted in dollars-per-troy-ounce, as it is today, the gold price was quoted in dollars-per-$100-in-specie. In other words, the number of Greenbacks required to purchase $100 in gold coin (about 4.84 oz).

By the end of the Civil War, somewhere between ⅓ and ½ of all US circulating paper was counterfeit! Both North and South had been printing phony notes to debase the opposition’s currency. At one period during the war the gold price was as high as $300 per $100 in coin. These huge price spikes never lasted too long, since gold would quickly funnel in by paddle steamer from Britain or by rail from Canada, to take advantage of temporary high prices. In the aftermath to the war, gold typically traded in a $130 to $140 per-$100-in-coin range.

Jay Gould and Jim Fisk Jr. fitted right in with the postwar era of Robber Barons and Carpetbaggers. The two had chequered careers on Wall Street and had made and lost fortunes. They saw opportunity, and together schemed a plan to make themselves – and a small clique of friends and insiders – wealthy beyond imaginable.

If you were an importer in a US port city, gold was fundamental to your business and a scarcity of physical gold would mean you couldn’t pay your import duties, or your foreign suppliers. In those days before electronic transfer, moving strongboxes of bullion and coin around the country was no mean feat, and kept folks like Pinkerton and Wells Fargo busy supplying the “grease” to the wheels of international commerce. Communication and transport being what it was, it could take weeks for coin and bullion shipments to cross country from San Francisco to New York, or for shipments of bullion to cross the Atlantic by paddlewheel steamer.

Gold was vital to a city like New York, where stevedores daily handled huge amounts of cargo at its many docks, wharves and piers. What Gould and Fisk sought to do was “corner” the gold market – not the entire international market (there was none), but just the local market in New York City – and for a short period of time only. Gould was a partner in a brokerage firm, and he knew that the gold market was small enough that large purchases on the New York Gold Pool could “bull” up the price, because there was always constant demand for the metal and a finite local supply. The gold could be lent out for greenbacks which were used to repay the original seller. If the order was large enough it was sure to send up gold prices and accrue profit for the trader – this was a veritable “license to print money”. The plan was to constrict the gold supply by buying up most of the coin and bullion available. Merchants would be forced to pay the higher prices for gold or suspend their business. At any given time there was only about $15 million in gold coin circulating in New York. Locking up a goodly percentage of it was do-able by someone with deep pockets, or a syndicate of wealthy individuals.

There were two keys to this plan: firstly, access to large sums of available cash in order to make the gold purchases. That was easy through their crony Boss Tweed and the Tenth National Bank which certified their cheques. The second key – and the wildcard – was the Federal Government. Tackling that was no easy matter –

The US Treasury maintained a reserve of about $100 million in gold. Any squeeze on the New York gold supply would induce the Treasury to accelerate their bond redemption programme and make gold immediately available to the market. The Treasury took its orders from the Commander-in-Chief, President Ulysses S. Grant. If Grant could somehow be induced into keeping gold in the Treasury coffers, their scheme would work. How to get to Grant on side?

They approached Grant obliquely, through his brother-in-law Abel Corbin. Corbin was presented with the scheme and given a piece of the action. He cosied up to his famous relative and got Gould a personal audience with the Big Guy. Gould argued that a cheap dollar would enable American farmers to export their crops more easily because European gold would buy more wheat and cotton. The unreadable Grant liked the idea, though he didn’t let on at the time. Corbin would later report back to Gould that all was well to initiate the “corner”. Later, the popular press would be recruited to spread the rumour that Grant was against official gold sales, and later still the press would accuse the President of complicity in the scheme.

A second refinement came later as the game was afoot: as Gould and Fisk began to ramp up metal prices through purchases of physical gold, bankers and merchant houses fought to bring the gold price down by borrowing gold and selling it into the market, thus attempting to balance out the shortage, or even turn the tide and temporarily bolster the supply. Gould and Fisk lent their gold out – many times over and anonymously, through small brokerages – so that they could later turn the screws on the borrowers by demanding margin calls (the difference between the price when gold was borrowed and the current price). Gould and Fisk didn’t intend to break the shorts; only to have them owing them huge sums on paper. Since they would then deal from a position of strength the actual settlements could be finalized over cognac and cigars at their opulent Opera House offices. They would lend the gold out, buy it back from the borrower and lend it out again. In this way they ultimately controlled 5 times the New York physical supply.

The scheme was started by Gould in August, 1869, when the price was $135 (per $100 gold). By the third week of September a titanic battle was being waged by Bulls and Bears – the Bulls representing Gould and Fisk’s Gold Ring, and the Bears the old money New York banking establishment. US trade had ground to a halt – there was no gold to pay for imports, and exporters were loath to sign contracts that locked in a gold price in a time of tremendous volatility. Offensive wave after offensive wave of gold buying was launched by Fisk and his henchmen. The bears threw huge lots of gold on to the market to bring down the price but it was like a garden hose on a forest fire. The shorts were skewered. Facing huge margin calls the brokerages began to fail one by one. Wall Street took on the appearance of a fairground, replete with hawkers and peddlers, and onlookers came from far and wide to witness the spectacle. Every up-tick in the gold price was greeted by cheers and groans.

On a day that came to be known in the popular press of the time as Black Friday – September 24, 1869 – the game finally ended. There was real fear of a “panic” such as had been witnessed in 1857, and the government decided it must take action.

Before the market had officially opened, the gold price was already up to $150. Fisk’s agent upped the price in dollar, then two dollar, then 5 dollar increments. Not much gold was offered – there wasn’t much to sell – but for every dollar increase, Gould and Fisk made millions on margin calls from borrowers. Then the news went around that the Fed would sell $4 million in gold the next day. The shorts found new courage and began an avalanche of selling that crashed the price from a high of $162 to $133 in minutes. The police were called and the market degenerated into bedlam. Gould and Fisk, who had been pulling strings from a nearby office discretely ducked out the back way as a lynch mob approached. However, all was not lost. Through the day Gould had been quietly selling through nominees as gold inched upwards – was he breaking ranks with Fisk or was it prearranged? We will never know. So many trades were made that the Gold Exchange – the clearinghouse for gold trades – was backlogged for a month and had to call in a small army of bookkeepers. Lawsuits abounded and bought judges would eventually null many of the trades. No telling what Fisk and Gould made after the dust had settled. To find out their ultimate fate, and for a captivating blow-by-blow narrative of the lock-up scheme find yourself a copy of The Gold Ring.

Reading this book almost the same time as John Embry’s classic treatise on the Gold Manipulation – Not Free Not Fair: The Long-Term Manipulation of the Gold Price (downloadable from www.sprott.com) I couldn’t help but wonder if history was once again repeating itself…..and, if Mr. Embry was right, how would it all end? Would we eventually see a bunch of central bank governors doing the “perp walk”? Or would an angry mob hunt them by torchlight as in olden days? Would Germany or France break ranks and find new courage to embrace gold as they had for centuries? Would China, who surely keeps its dollars only because of fears of mutually-assured-economic-destruction turn renegade and trade their paper for tangible metal? Heck, would the Oracle of Omaha get the inside skivvie on what’s in Fort Knox and take a run at gold? Supposing Embry is right and the most of the world’s Central Bank Reserves were sold off years ago and are now dangling round the necks of young wives in Bangalore and Mumbai? Wouldn’t that mean a dangerous shortage of metal? Could someone with inside information on the true state of the gold supply and Central Bank Reserves attempt to corner the gold market? Of course the premise of Embry’s argument is that a cabal of forces have conspired to keep the gold price down – not to raise it up, like Fisk and Gould did. Whatever the outcome of current developments in the gold market, I am confident that 100 years from now our great grandchildren will be reading about them.

Indeed, history is nothing more than a tableau of crimes and misfortunes.

-Voltaire

Fun Gold Facts

The word “gold” has its origins in the Indo-European word “ghel”, meaning yellow. The chemical symbol of gold is Au, which is short for the Latin word for gold “aurum”. “Electrum”, a natural alloy of gold and silver, comes from the Greek word “elektron”, meaning “amber”, and was a term first used by Pliny the Elder, a Roman nobleman and historian, in his volumes of “Natural History” in AD 77.

Fire Assay

For a good while I’ve been meaning to write a short summary of what is meant by “fire assay”, since it figures so prominently in press releases and reports on mining properties.

Back in the dusty Straight Talk archives I found a 1996 article in the Vancouver Sun concerning the use of non-conventional methods to determine platinum and other precious metals in samples of “desert dirt” from a property in Franklin Lake, California. The company claimed to have 7 ounces of platinum group metals per ton of rock. After the property failed to live up to these fantastic results in an investigation by the Alberta Securities Commission – where fire assay figured prominently as the ultimate say on the precious metals content – the promoter eventually agreed to a 10-year ban on any involvement in the stock market, and the company was delisted.

It is perhaps ironic that the same issue of the paper carried an article discussing the use of a cyanide leaching process by Bre-X Minerals for their Busang samples. As an Alberta Exchange listing, Bre-X would be required under new rules to disclose fire assays and there was concern amongst investors, because the company had been routinely using cyanide leach. The V.P. Stephen McAnulty claimed that the use of cyanide was justified because of coarse gold in the samples (which we now know was nefariously introduced alluvial gold). McAnulty was quoted as saying, “There’s so many misrepresentations, some of them gross, some of them mild.”

Fire assay has NEVER failed to identify paying ore, and so, if someone claims spectacular gold results from “ore that is not amenable to fire assay” or they use a “proprietary process to analyze for gold”, take your money and run!

There’s another side to this though… when taking samples for assay it’s important to disclose whether or not the material is representative. In 1868, at Meadow Lake, California it was reported that a ½ walnut-sized piece of ore assayed $93,770.97 per ton. Over 60 years the whole mining district produced barely twice that amount.

It’s very easy to sit on an old ore pile for half a day and collect or “high grade” samples with visible gold. Not too long ago I saw a press release from a company (that ought to know better) that released extremely high grade sample results from an old ore pile. Don’t be misled by this kind of stuff because chances are it’s highly unlikely that the abandoned mine next to the ore pile ever typically produced those high grades. Mining analysts often look for results from diamond drill core. The diamond drill is sometimes called the “truth machine” in mining circles, because it samples blindly. Mining promoters know the saying, “drill it and kill it,” because many prospects only exist by virtue of selective surface sampling – the best stuff, or in the highest grade spot. Many gold prospects fall by the wayside once drilled.

Fire assaying has been around for a lot of years and dates back as far as the age of alchemy and the search for the Philosopher’s Stone. There is though no magic that can change dross into gold – only sleight of hand.

Laboratories use basically the same methods for fire assay the world over. The first step is crushing the rock, usually in a soft-iron jaw crusher or roller. Unless it’s required to pulverize all the coarse material, normally only a portion is taken to the next stage and pulped (ground to rock flour) using a special tungsten carbide mill. Depending on the requirements of the client, normally 30 grams or 50 grams of rock flour would be carefully weighed out on a balance. This becomes the assay charge. In the USA some labs still weigh out an assay ton or 29.167 grams. One ton of ore contains 29,167 troy ounces and so use of an assay ton makes the math easy. The unused portion of the pulp and the unpulverised coarse rock material (the reject) are typically kept aside and stored so that check assays can be done if required.

The assay charge is placed into a crucible – a small ceramic cup for fusion or melting in the furnace. An amount of flux is added to the crucible and the mixture is fused at high temperature in the furnace. Fluxing agents include lead oxide or litharge which is used as a collector of precious metals. The flux also might contain silica, borax, soda ash, potassium nitrate and household flour. Each laboratory has its own recipe to coax the precious metal out of the rock…(it’s not legal to add gold by the way – see below). In the furnace the litharge is reduced to lead metal. The lead droplets collect the gold and silver and a glassy slag forms at the top of the crucible. On cooling, a lead button containing any precious metals is broken from the slag.

The lead button then undergoes a secondary process called cupellation. In cupellation the lead button is again heated in a furnace at 960°C to 1000°C, but this time in a bone ash cup or cupel. On oxidation, the lead turns back into lead oxide, which is absorbed into the cupel itself, leaving a small round bead or prill of precious metal. On cooling, the prill is carefully extracted from the cupel. At this stage it is doré – a gold/silver mixture. The prill is then weighed, flattened out and rolled until very thin, and then placed in nitric acid, which dissolves away or parts the silver. The difference between original weight of the bead and final weight is the silver that was contained. The final step of weighing is called gravimetric finish. In samples where the residue from cupellation is too small to weigh, it can be dissolved in aqua regia and then analyzed using atomic absorption (AA finish) or other technique. The final step in the process involves a calculator; where the weight of the recovered gold is compared with the original assay charge. It then becomes a simple matter to backtrack the gold content in grams-per-tonne, parts-per-million, or ounces-per-ton, depending on your preference.

Note the following well because many people mess this up!

if converting from ounces per ton to grams per tonne: 1 troy ounce = 31.1034768 grams, but a troy ounce/ton using a conversion of 31.103481 gives you only GRAMS PER SHORT TON. To complete the metric conversion you must also convert short tons to tonnes using the conversion factor 0.90718474.

So: 31.1034768 grams per ton ÷ 0.90718474 = 34.2857142 grams per tonne.

“Assaying was a good business, and so some engaged in it, occasionally, who were not strictly scientific and capable. One assayer got such results out of all specimens brought to him that in time he almost acquired a monopoly in the business. But like all men who achieve success, he became an object of envy and suspicion. The other assayers entered into a conspiracy against him, and let some prominent citizens into the secret in order to show that they meant fairly. Then they broke a little fragment off a carpenter’s grindstone and got a stranger to take it to the popular scientist and get it assayed. In the course of an hour the result came – whereby it appeared that a ton of rock would yield $1,248.40 in silver and $366.36 in gold! Due publication of the whole matter was made in the paper, and the popular assayer left town ‘between two days’.”

Mark Twain

Roughing It

1872

Straight Talk On Mining Insights on mining from economic geologist Dr. Keith Barron.

Straight Talk On Mining Insights on mining from economic geologist Dr. Keith Barron.