“Since we decided a few weeks ago to adopt the leaf as legal tender, we have, of course, all become immensely rich.”

Ford stared in disbelief at the crowd who were murmuring appreciatively at this and greedily fingering the wads of leaves with which their track suits were stuffed.

‘But we have also,’ continued the Management Consultant, ‘run into a small inflation problem on account of the high level of leaf availability, which means that, I gather, the current going rate has something like three deciduous forests buying one ship’s peanut.’

‘So in order to obviate this problem,’ he continued, ‘and effectively revalue the leaf, we are about to embark on a massive defoliation campaign, and…..er, burn down all the forests. I think you’ll agree that’s a sensible move under the circumstances.’

The Restaurant at the End of the Universe – Douglas Adams

“By the pricking of my thumbs, Something wicked this way comes”

Macbeth Act IV Scene 1

Can you believe the fix that the West is in? Interest rates lowered artificially to near-zero or negative to forestall deflation? Clinton lauded as the President under which the economy showed a surplus, though he and Bernanke birthed the Dot.com Nasdaq Bubble, which birthed the housing Bubble and asset-backed securities Bubbles and because no one is allowed to really go bust…. Freddy & Fanny get bailed out, GM gets bailed out, most of the world’s senior banks get bailed out, we have QE1, QE2, QE3 and Operation Twist and STILL the world can’t kick it back into high gear. Just think of all the loot that got consumed in the Afghanistan, Iraq and Syria wars! Not even to consider the costs of Homeland Security! Shouldn’t $40 oil kickstart everything?

So what’s coming folks? Well, it’s an idea just about as lunatic as making tree leaves currency… more and more you are hearing the term “helicopter money”. Helicopter money is a reference to an idea made popular by the American economist Milton Friedman in 1969.

Let us suppose now that one day a helicopter flies over this community and drops an additional $1,000 in bills from the sky, which is, of course, hastily collected by members of the community. Let us suppose further that everyone is convinced that this is a unique event which will never be repeated.”

Hey, hey, everyone loves free money right? Well it has to be got from somewhere, and yes you guessed it – Central Banks would just conjure it out of thin air. This is not trickle-down Reaganomics, this is a straight in-your-wallet Keynesian inspired throwing of money to the populace to drive consumption and (hence in theory) the economy. Call it what you will, a tax break or Universal Basic Income (as was recently defeated in a plebiscite in Switzerland http://www.bbc.co.uk/news/world-europe-36454060) but it is increasingly being seriously considered in this current age of nuttiness.

- https://www.bloomberg.com/view/articles/2016-03-22/friedman-s-money-dropping-helicopter-gains-speed

- http://www.brookings.edu/blogs/ben-bernanke/posts/2016/04/11-helicopter-money

- http://blogs.wsj.com/economics/2016/03/21/the-time-and-place-for-helicopter-money/

- https://next.ft.com/content/4b6ee16e-110c-11e6-91da-096d89bd2173

- http://www.reuters.com/article/us-japan-economy-boj-idUSKCN10B00Y

- http://www.nytimes.com/2016/07/29/upshot/helicopter-money-why-some-economists-are-talking-about-dropping-money-from-the-sky.html?_r=0

Mark well the following by Ben Bernanke in 2002: “Deflation: Making Sure “It” Doesn’t Happen Here”:

“But the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost. By increasing the number of U.S. dollars in circulation, or even by credibly threatening to do so, the U.S. government can also reduce the value of a dollar in terms of goods and services, which is equivalent to raising the prices in dollars of those goods and services. We conclude that, under a paper-money system, a determined government can always generate higher spending and hence positive inflation.

Of course, the U.S. government is not going to print money and distribute it willy-nilly…..

(Oh ya???? Well you can bet your sweet bippy that that’s EXACTLY what’s going to happen!)

How is this going to end? Well, it won’t be pretty. The US Government wants desperately to generate inflation in order to pare down the debt; repaying obligations in depreciated dollars. Governments also think they are smarter than the rest of us and can tweak everything “just right” as Goldilocks would say, so that inflation doesn’t run away. But this is another Fairy Tale where no one lives “happily ever after.” There are scores of historical examples of governments comprised of “the best and brightest” who have overstepped and destroyed their own currency.

For the rest of us, inflation is a pernicious evil which erodes the value of our savings and investments. The age-old defense from profligate governments is precious metals.

John Law and the First Financial Experiment

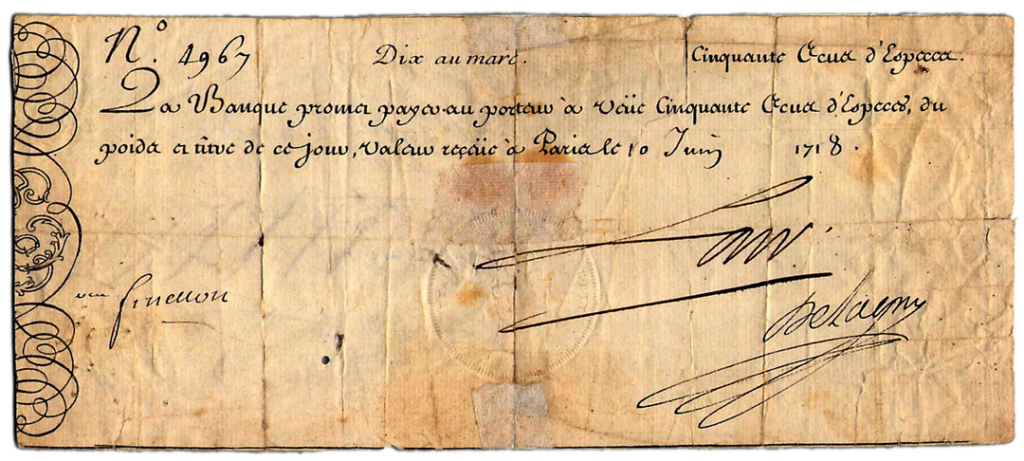

Followers of this Blog both old and new know that I have a penchant for arcana and trivia and that I love history. A few months ago out of the blue I was approached by a coin dealer who asked me would I be interested in purchasing an original signed John Law note? For those not familiar with this particular Scottish rapscallion there is a fascinating history: “Millionaire: The Philanderer, Gambler and Duelist who Invented Modern Finance”, by Janet Gleason. When the book came out in 1999 I bought dozens of copies and handed them out. It’s still available on Kindle.

After much humming and hawing and to-ing an fro-ing I bought the note and it now has the place of pride in my Dead Money Collection, along with some Assignats, Weimar Marks, and Zimbabwe dollars as testaments to the great hyperinflations of the ages. The note is one of only four survivors personally signed by Law, of the 200,000 plus that were issued, and, it’s the only one in private hands.

Law came from a privileged background, the son of a goldsmith in the city of Edinburgh. Since goldsmiths often acted as neighbourhood bankers back in the day, presumably Law learnt the rudiments of banking at an early age. He also had a great facility for juggling numbers, and clearly aspired to be one of the “Beautiful People”, or at least to hang out with them. He took up gambling at an early age and amassed a large fortune through his winnings. Through his prowess at the card tables he hobnobbed with noblemen and aristocrats, as well as royalty. This he accomplished through mental arithmetic, card-counting, and “reading” people; in a way all important skills for what was to come.

At the tender age of thirty he wrote “Money and Trade Considered with a Proposal for Supplying the Nation with Money.”

https://ia801406.us.archive.org/2/items/moneytradeconsid00lawj/moneytradeconsid00lawj.pdf

Wading through this document in the original, with its old-fashioned “f’s” instead of “s” is not for the faint-hearted, though I found it fascinating. Adam Smith would have certainly read a copy, and the proponents of Assignats; the ill-fated currency of the French Revolution, and I’m willing to bet that other rapscallion John Maynard Keynes also read it. Aye there’s the rub! I bet you this is where Keynesian Economics has its roots!

John Law firmly believed that (as Mark Twain said), “The lack of money is the root of all evil.” I’m not being facetious. Law believed that trade and commerce were inhibited by a lack of liquidity, which in turn stymied lending. In a strictly precious metals economy it was difficult to encourage commerce because of the restricted supply of metal circulating. However, as the Medici’s and later the Amsterdam bankers had figured out, if you issued paper claims on the gold and silver plate and specie in the vaults, you could…..issue more claims than what was IN the vaults, provided that the claimants didn’t come to you all at the same time, i.e. a run on the bank. This became the basis for the Fractional Reserve System, whereby countries could issue paper money backed to greater or lesser extent by assets held by the Government. At first this took the form of bearer notes, but later it was perverted into inconvertible fiat currencies backed by “the Full Faith and Credit of the United States” (or Canada, or UK, or Mickey Mouse or Whomever, take your pick)…..but I am getting ahead of myself.

Law said that the silver used for currency was subject to debasement by foreign governments, or, inflation against other assets due to the ever increasing mine output from places like Potosi and Mexico. Poor Scotland had plenty of sheep but no precious metal mines to speak of. So he suggested that a paper currency be issued, backed by land (not by sheep). (This land idea was later adopted in 1789 by the French Revolutionaries, who used the seized Catholic Church lands to back the Assignats).

Law wrote his anonymous unsolicited treatise for the Scottish Crown – it was published by a printing firm controlled by his Aunt… a year before the Treaty of Union, forming the UK. It didn’t take long before it was known he was the author. The scheme was discussed in the Scottish Parliament and he was branded a Dangerous Whacko. “Too chimerical to be put in practice”, was one comment. It didn’t help that he had an outstanding arrest warrant in England for murder and breaking out of prison (a minor point; read the Biography). With looming union between Scotland and England, and the prospect of arrest and capital punishment, Law had to hightail it outta there, and went to live in permanent exile on the European Continent.

Eventually he loped through the gaming rooms of Paris and came to the attention of Phillipe, the Duc d’Orléans…. and as it so happens the King’s nephew. He found a sympathetic ear in Phillipe and discussed his treatise at great length. Fate intervened for John Law to finally put his great monetary experiment into practice a few years later with the death of Louis XIV of France. Louis’ second great-grandson, a five year old, became Louis XV, and Phillipe, the Regent.

Louis XIV, also known as The Sun King is famous for having constructed the Palace of Versailles, and for fighting three major wars and two minor ones. According to Alasdair Macleod, when he died in 1715 after 72 years on the throne he left the state three billion livres in debt, which was the equivalent of 1,840 tonnes of gold. This was about 85% of the world’s estimated gold stock at that time, at the livre’s conversion rate into Louis d’Or. The TV show “Versailles” started airing on the BBC in June (http://www.telegraph.co.uk/tv/2016/06/05/dwarves-sex-and-spies-how-historically-accurate-is-versailles/) It’s pretty fair, but even computer generated graphics can’t accurately convey the opulence of the French Court. Think Michael Jackson’s Neverland Ranch X 1000. When the Sun King died France was utterly stony broke.

John Law hustled back to France to meet with the new Regent and convince him to reflate the economy by printing paper money, first as bonds in the Banque Générale Privée (renamed Banque Royale in 1719) and then as banknotes. At first, the scheme seemed to work, and France was able to pay down the national debt. Then things took a different path, when the currency was backed by shares of the Mississippi Company, which in turn owned the Louisiana possessions in North America. Mississippi Company shares were mercilessly and shamelessly promoted in the press and by Law himself. Louisiana was regarded as a combination “Land of Canaan” and “New Eldorado”. No mention was made of yellow fever-ridden swamps full of gators.

The stories of “feeding frenzy” stock trading on the Rue Quincampoix (looks like a tongue-twister but really isn’t) are both amusing and sobering – beggars becoming aristocrats and buying landed property, servants quitting their jobs to purchase country chateau larger than the houses they previously worked in – Law and his many hangers-on became immensely rich. But like all Bubbles it was soon to burst. Rumours came back from the New World that all was not as it seemed, and a few Michael Burry and Mark Baum types started to quietly sell shares, take the proceeds in gold, and sneak it across the border.

In a matter of days confidence was broken. When the bank was mobbed by those wanting to convert their paper into gold & silver, Law, who by this time ran both the Mint and the Mississippi Company had edicts passed to ban all transactions in specie. When people began to convert their paper money into jewellery he had that banned, except for crucifixes. When gold crucifixes were then bid into the stratosphere he had them banned too! Soon everything degenerated into chaos, and Law had to flee the lynch mobs. Thus endeth the lesson.

Helicopter Money is coming soon! A huge percentage of the developed world’s bond issues are now “earning” negative interest. This is not sustainable. All the pension funds invested in bonds are gonna collapse unless something drastic is done, and done soon. You will see things in the coming months and years that will defy all logic and will go against all the rules of Economics and Commerce.

Since the US Republican and Democratic Conventions are hogging the headlines recently, I will close with a line from Ronald Reagan’s 1992 National Republican Convention address. He said, (referring to the freedom and prosperity of America) “You ain’t seen nothing, yet!”

__________

Truly,

“Boy, You Ain’t Seen Nothing Yet!”

Straight Talk On Mining Insights on mining from economic geologist Dr. Keith Barron.

Straight Talk On Mining Insights on mining from economic geologist Dr. Keith Barron.

“Can you believe the fix that the West is in? Interest rates lowered artificially to near-zero or negative to forestall deflation?” Can you believe that anyone believes this? What ZIRP and NIRP mean is, to the extent that each nation can be saddled with new debt, the very banks(and their subsidiaries) which own the central banks are given money, interest-free, with which to pick the bones of distressed resource producers.

Consider this, Mr. Barron: the only U.S. cabinet-member to do jail time* went down for …..drum-roll…. accepting an interest-free loan. Does that tell you anything?

*Albert Fall, Interior Secretary, in the Teapot Dome Scandal. He had accepted a one million dollar interest-free loan from Sinclair Oil to grease the skids for their getting drilling rights in the strategic petroleum reserve. The legal theory being, his having to pay the loan back $1/yr amounted to a bribe. Compare this to trillions, interest-free in TARP and QE, and Teapot is truly a pee-pot.

The government ploy of deceiving humanity will not continue indefinitely, Once the derivatives market collapse, and money literally becomes worthless… all confidence will be lost in the system…. and we will return to a tumultous dark age. Truly gold and silver may be valuable for a short time, but in a world lost to chaos and anarchy, Maslows most basic requirement of needs will be most important… food, shelter, safety. Unfortunately there is no turning this beast around, history shows us the next destination is impoverishment, war and utter ruin.