The following is for the gold bugs – succinct and to the point:

Some people would assert that if governments were prepared to accept monetary discipline there would be no need for gold, but this is rather like the statement that if there were no sin there would be no need for laws. In the effort to please (or bribe) their voters, governments are under constant temptation to do things that, directly or indirectly, lead to monetary expansion and inflation; and it may be easier to resist such temptations if the authorities are subject to some form of external discipline, even though it is one to which they have voluntarily submitted. Politicians cannot be expected to accept such a curb on their powers unless the public demand for it is so strong that acceptance is the only way to get elected.

From Gold or Paper by E. Victor Morgan & Ann D. Morgan, 1976

Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.

Lots of quotes today.

The above words by Sir Winston Churchill and the Morgans encapsulate the where we are and the why. There has been much hand wringing today over the drops in the gold and silver spot prices. If you convince yourself that the rise in commodity prices is due to the ephemera of any given day a la Marketwatch, CNBC, Fox News, Reuters or AP (take your pick….could be Iran nuke threats, oil price shock, Nigerian rebels, etc. etc. etc.) and that the precious metals market is a bubble, then carry on with your blinkered existence and don’t read anything into the fact that the US Fed has stopped reporting the numbers for the M3 money supply.

Gold, silver, base metals, natural gas, oil, and practically all other commodities are going up in price because of inflation. Inflation is too many dollars chasing too few goods….it is a concept that few seem to grasp in this dumbed-down media era in which we live. Instead the financial reporting world dismissively wave such things away and blame price rises on shortages or gouging. It is INFLATION pure and simple!

From the editorial in the back of Barron’s this week: “not even the supply and demand for gold is stable enough to make the “barbarous relic” a reliable touchstone for the value of money. The recent rise in the dollar price of gold is as much due to a change in policy from some foreign central banks as it is to any suspicion (well-founded though it may be) about U.S. dollar debt or the purchasing power of the dollar.

Codswallop!

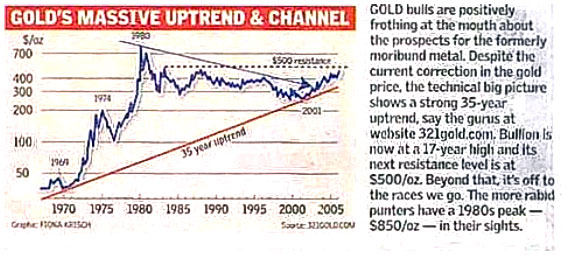

The spectacular price activity of gold and silver over the last week are phenomena unavoidable for the mainstream press to comment upon. I have seen perhaps a dozen press articles, almost all of which attach the caveat at the end about the all time high of $850/oz January 21st, 1980 and the 20 or 25 year (take your pick) bear market that ensued. This is all pretty much disingenuous rubbish. The bear market days were only really for 5 or so of those years when the dot.com machine was in full throttle and gold mining was not making much money.

Kudos to the Sunday Times of South Africa, October 16th, 2005 from which I clipped this nugget. This is one of the few unabashedly bullish pieces on gold I have seen in the mainstream media. Those who took note of it when it appeared have assuredly made money.

When I attended the San Francisco Gold Show in December, 2005, the gold price crossed over into +$500 territory, however I was so deflated by the response this event seemed to be getting that I actually began writing a piece entitled “Not with a bang but a whimper”, after T.S. Elliott’s famous poem “The Hollow Men”. Thank goodness I didn’t put it out, because within hours it seems the gold price started to begin its rapid ascent.

Whatever way the media choose to spin the gold price – and most choose to fence sit – those people who have been knocking gold for years now are sounding more and more like “Hollow Men”. There is no denying that gold is very significantly up in price since the heady dotcom daze of 2000-2001. As someone who has been watching the gold price for decades, I always know the bias of a publication when I see the gold price graph they are using…. I’d say most of the time, the idiot press would choose to begin their graph at the all-time high of January, 1980, when the price was at its peak. The gold price since then looked like a ski slalom, with a precipitous drop. With gold in $620 territory the graph is starting to look more like a parabolic mirror than a ski slalom. The naysayers will continue to tell you that gold is still doing poorly in 1980 dollars because of inflation. They will tell you this bull run is almost done. They will tell you that this bull market cannot be sustained. Disregard it, because gold is probably going to go a lot higher still.

The January 1980 top in the gold market was what we call the manic phase in the market; when everyone is leaping in, when gold was the subject of conversation at every cocktail party and around every water cooler. Gold was going up $50 in price each day. We are a long way away from this type of activity. But, we sure have seen it in recent years in the internet stocks and the housing market haven’t we? I would say that times are such that a manic buying frenzy in precious metals is completely and entirely conceivable, even predictable. Why? Inflation.

Disaster Preparedness

In North America and Europe, spring season is here and for the most part the fires, floods, and hurricanes of last year are but an unpleasant memory. Hurricane season is well past in the USA, but Queensland, Australia is taking a beating right now, and places like Tennessee are getting their annual pummeling from tornados. Last year was quite something for natural disasters. The Asian Tsunami struck December 26th 2004 but it wasn’t until the early days of 2005 that reporters were able to get access to many areas and see the magnitude of the devastation. America was hit with three major hurricanes: Katrina and Rita in quick succession, and then Wilma. I flew over Miami a couple of days ago and still there are plenty of blue tarpaulins on damaged roofs. Last year the mountains of Kashmir and the foothills of the Himalayas were hit with a massive 7.6 magnitude in the Hindu Kush. On April 18th at 5:12 AM Pacific Time was the 100th anniversary of the great San Francisco Earthquake.

In Louisiana and Mississippi, homes and local banks were “wiped to the slab” by Katrina. Banknotes were reduced to a pulpy mass and covered with a combination of diesel oil, pesticides and raw sewage. For those already weary survivors, convincing the check-out girl at the local 7-Eleven where you had been evacuated that what you offered in your hand was indeed money became a beyond-the-pale task.

Incidentally, for those hapless folks who may have to call on the services of the Treasury Department’s Bureau of Engraving and Printing (BEP) in Washington D.C. ; according to Coin World they handled more than 26,000 mutilated currency claims in 2005. “If the currency is seriously damaged or mutilated it must be sent to the BEP for examination and identification after which the claimant will be reimbursed for its face value by a U.S. Treasury cheque. The standards by which mutilated currency can be exchanged at face value are: (1) at least 51% of a currency note is present and identifiable, or (2) 50% or less of a currency note is present and the submitted evidence justifies the method of mutilation and the U.S. Treasury is satisfied that all missing portions of the currency note have been totally destroyed.”

Sounds pretty complicated huh?

Apologies to Matthew 6:19, but gold is the only treasure where moth and rust doth NOT corrupt.

Turning to man-made disasters: through history, gold has got many people out of tight scrapes, be it the coins and ingots handed over for passage on rickety rafts by the Vietnamese boat people to the bangles and jewellery handed to corrupt soldiers I watched last week in the film, Hotel Rwanda. Even in fiction, James Bond 007 had 50 gold sovereigns hidden in the lining of his leather attaché case in From Russia with Love; Major T.J. “King” Kong (Slim Pickens) had 100 dollars in gold in his survival kit along with a “combination bible and Russian phrase book and 3 lipsticks” in Dr. Strangelove. Gold stays money after the social fabric has been torn to pieces.

The majority of folks reading this are not imminently threatened by natural disaster or mob violence. Your parents or grandparents might have stashed some gold behind a few bricks in the cellar because they had lived in a very different time, with a couple of World Wars, a pogrom or two, and a Depression. To do so today seems so old-fashioned. To say it’s important is like Chicken Little saying the Sky is Falling.

However, there are other disquieting things out there which threaten our comfy existence; more subtle and pernicious and not apt to make it into sound-bite CNN coverage ….INFLATION.

Sometimes in order to understand the gold and silver markets you need to look at other markets like energy and the base metals. For the next couple of paragraphs I’m going to focus on base metals. Take the 30 second test. How many articles of metal can you come up with? Here’s my list:

Safety pins, propane cylinders, guard rails, automobiles, thumbtacks, locomotives, wing nuts, oil tankers, construction cranes, soda pop cans, lightning rods, CD coatings, pipelines, paperclips and pennies.

All of these essential parts of 21st century life (some arguably more so than others).

In order to get a proper picture it’s often necessary to back away from the canvas and stare at it from the middle of the room. You can’t divine much from a 1 month chart due to noise caused by volatility. Let’s look at the 5 year graphs for aluminum, copper, lead, nickel and zinc. Start with http://www.kitcometals.com/charts/ and then scroll through the various historical charts for the metals listed on the left hand side of your screen when you click on the above link. Every one of these metals is in a bull market. Zinc and copper are just as parabolic as gold and silver. This is not just a spike or a blip on the graph…this is a very disquieting trend built over time which is metal market wide.

So… if the metals are all going vertical, and yet inflation (as measured by the Hollow Men) is flat or minimal there is something that doesn’t compute in the official figures …or… manufacturers are taking it on the chin and not passing the costs on to the consumer. Not yet anyway. Take car manufacturing. In the average automobile there’s 17 pounds of zinc in the form of galvanized steel for rust proofing. Another 20 pounds go into die cast parts like door handles, locks and trunk latches. Each tire contains about half a pound of zinc which is used to cure rubber. A car battery contains 18 pounds of lead, and another 9 pounds is used in soldering and other components. There’s 42 pounds of copper in a car in the radiator and wiring. The average passenger car also contains 267 pounds of aluminum. Nickel provides a few pounds as catalyst supports, exhaust systems, and safety belt springs. I haven’t even counted the steel…

With metals going higher it seems obvious to me that the price of every item made of metal is going up – unless manufacturers eat the increases and slash their costs (pensions, workforce) to stay competitive (think car manufacturers). Should the increased costs of production translate into a consumer pull back…downturn, recession or even dare say “deflation”. Well…..in the Sage Words of Mr. Bernanke:

Like gold, U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost. By increasing the number of U.S. dollars in circulation, or even by credibly threatening to do so, the U.S. government can also reduce the value of a dollar in terms of goods and services, which is equivalent to raising the prices in dollars of those goods and services. We conclude that, under a paper-money system, a determined government can always generate higher spending and hence positive inflation.

Remarks before the National Economists Club, Washington, D.C. November 21, 2002

In the words of an editorial in yesterday’s Wall Street Journal, entitled “Betting on Bernanke”: “Our own surmise is that Mr. Bernanke may be muttering to himself that Mr. Greenspan skipped town just in the nick of time.”

(Ode to a Central Banker): The Hollow Men: T.S. Eliot

We are the hollow men

We are the stuffed men

Leaning together

Headpiece filled with straw. Alas!

Our dried voices, when

We whisper together

Are quiet and meaningless

As wind in dry grass

Or rats’ feet over broken glass

In our dry cellar

This is the way the world ends

This is the way the world ends

This is the way the world ends

Not with a bang but a whimper.

Straight Talk On Mining Insights on mining from economic geologist Dr. Keith Barron.

Straight Talk On Mining Insights on mining from economic geologist Dr. Keith Barron.