It’s a sure thing I’m tellin yer,’ said the man again and again, bringing his face close to Ed Thatcher’s face and rapping the desk with his flat hand.

‘Maybe it is Viler but I seen so many of em go under, honest I don’t see how I can risk it.”

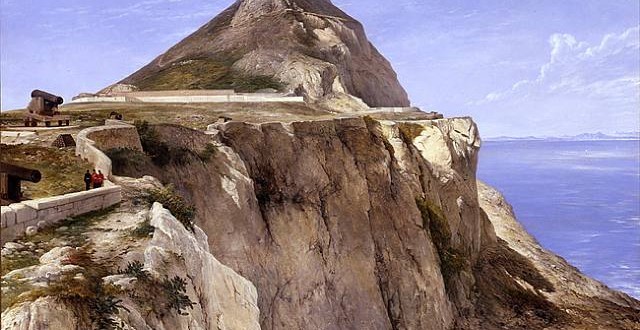

‘Man I’ve hocked the misses’ silver teaset and my diamond ring an the baby’s mug…It’s a sure sure thing…I wouldn’t let you in on it xept you an me’s been pretty good friends and I owe you money an everythin…You’ll make twentyfive percent on your money by tomorrow noon…Then if you want to hold you can on a gamble, but if you sell three quarters and hold the rest two or three days on a chance you’re as safe as…as the Rock of Gibraltar.’

– Manhattan Transfer – John Dos Passos, 1925

Junior Golds, Act I, Scene 1

It’s been three weeks since the last Straight Talk during which we’ve seen the gold and silver prices bounce around, and the DOW, S&P and Nasdaq take two steps forward….three steps back (cha cha cha). The broad market just can’t stop shooting itself in the foot. It reminds me of one of those old silent movies with the Keystone Cops, careening down a mountainside in an old jalopy without brakes, barely making the turns and imminently about to plunge down a chasm.

I dutifully went to the Vancouver Gold Investment Forum. I was impressed by the number of attendees, given that it was held in the middle of a work week. Some of the events like the Panel Discussion and Bill Murphy’s address were packed to the walls with nary a vacant seat. The mood was decidedly bullish. I went to make a phone call midway through the first day and overheard one side of a conversation that went, “Ya, some of these gold bugs are crazy, but there’s a lot of people down here. I think there might be something to this.” (I don’t usually eavesdrop, but in this case when I heard “gold bug” and “crazy” together in the same sentence my ears perked up). Sounds like this guy had been sent to see what all the buzz was about. Hopefully he is a new convert to the yellow metal.

The usual suspects were at the show. Goldcorp was there with the display of high grade specimen gold samples we have come to expect. There were a few newcomers, but not many. Most displays I had seen either at the January Cambridge gold conference also in Vancouver, or at the Prospectors and Developers Convention in Toronto in March.

Those with booths at the show were mostly junior Vancouver-based companies who are into exploration, and do not have operating mines. A number of the letter writers were there too, and I managed to pick up free samples from most of them. I did note that a well-known letter writer had loosely sprinkled the term “mines” throughout his newsletter when in fact the companies concerned owned “prospects” without any defined reserve or resource and certainly not in production. Another letter writer had mistakenly said that a property was located on the Destor-Porcupine Break near Marathon, Ontario, (he meant Matheson, they are hundreds of kilometres apart), but maybe I’m being pedantic.

To be frank, I came away somewhat disappointed, and what I am going to say will sound harsh to some. About 20% of the properties and projects being pedalled were what I consider to be junk – those with very little hope of ever being worthwhile. While the junior mining business has always contained a certain proportion of high promotion backed by little substance, I did expect greater things. I was heartened though by conversations I had the following week; more about that in a moment.

Something to bear in mind is that it has only been since March or April that companies have been able to raise money for exploration. It’s like the entire industry was at the starting line waiting for the starter’s pistol to go off. There are the odd persons with private funds out there who have been preparing for the bull market over the previous year or two, but to commit exploration money in a bear market takes conviction and steely resolve. Virtually no exploration company could expend money in gold and silver exploration until then, without getting lynched by shareholders. This is why former gold explorers were into diamonds, platinum and palladium. Those who have just sauntered into exploration in the last month or so and are heavily promoting properties have typically taken one of two tacts: they are picking up old mines or projects with small reserves to be “leveraged” to the price of gold, or have secured previously known gold prospects with high grade values.

Before going further I’d like to relate a small story that happened to me in 1990. At the time I was consulting for a major international gold company in the Kirkland Lake gold camp of Ontario. On the July 1st Canada Day holiday I was holding the fort in town. My boss had gone on field break, my field assistants had the holiday off and I was catching up on some paperwork. About mid-morning I heard the fax machine churning away as it spewed forth several pages of assays from the laboratory. I quickly cast my eye down the list of figures. One stood out from all the others – an assay of greater than 800 g/t of gold! It looked like a mistake, but the numbers had been checked and certified by the assayer. I went to our master file of samples to find where the high assay had come from. It was from a bulldozer trench we had dug to expose the rock, and had washed off with fire hoses; the individual assay came from a metre-long channel sample. [Note: a channel sample is made by making two parallel cuts of equal depth and about an inch apart in the rock with a diamond-bladed circular masonry saw. The intervening rock is then chiselled out and sent to the lab. What is left behind is a shallow cut or “channel” in the rock. A continuous channel sample can be considered like a horizontal, at-surface drill hole.] Since I didn’t have anything else pending that day I hopped in the truck and took a short drive down to our claims to locate the sample. Each sample had been meticulously labelled in the field using spray paint and a sample tag fixed with a nail pounded into the saw cut. I soon found the site. On my knees I scraped away the dirt that had washed down into the saw cut with the recent rain. I broke off one wall of the saw cut and took it over to a puddle to wash the mud off. The flat cut surface was smeared with gold! There was gold all through the rock! I carefully took some measurements: the gold was in a rusty quartz vein that was 28 centimetres in width which vanished along its length beneath the moss both sides of the trench. This part of the bulldozer trench was actually just a foot or so shy of an old timer’s hand dug trench from the 1930’s. I made a lot of notes, knowing that there would be plenty of questions from head office. After four or five rewrites I managed a short fax to headquarters that I knew wouldn’t be read until about 8:30 am next morning. I got the first call around 8:31 am……..

About three days later, my boss, and the Exploration Manager went with me to inspect the vein. After the Big Guy’s say so, we attacked it with a cold chisel and 4 lb sledge hammers for a nice sample to go on the V.P.’s desk and smaller samples for ourselves. We “mined” the whole vein in about 5 minutes. Several weeks later we put a drill hole directly beneath the vein and one either side of it and hit nothing. The vein was obviously something that lacked any dimensional extent, and was therefore a geological curiosity only.

It’s always enormous fun to find high grade gold, and I’ve done it numerous times over the years. However I want to convey two lessons from this story. The first is that new thinking and innovation (in this case a bulldozer to clear the rocks of glacial overburden cover) can be used successfully to make discoveries in mature mining camps. The Kirkland Lake area has been intensively prospected since 1908. However, no new mines have been found there since 1933. As a district becomes more mature the discovery rate drops off substantially and the cost of discovery typically escalates as more expensive drilling and geophysics are employed to find new deposits.

The second, is that despite best efforts most gold occurrences do not turn into mines. The industry record is that for each 1,200 or so occurrences there will only be one mine found. This doesn’t sound like good odds, but a look at the old files of the US Bureau of Mines or the Geological Survey of Canada will show that there are hundreds of thousands of known gold occurrences. The majority of these occurrences will never be mines because, the entire “orebody” can fit in the back of a pick-up truck, or, a shoebox (like in the story above).

At the Vancouver show I saw a small number of companies promoting gold occurrences that have been known for decades and sampled dozens of times. These occurrences or “showings” are well known for yielding flashy high grade assays. For those with little money, little time or little imagination – for it takes little of any – dozens of high grade gold showings can be secured in the greenstone belts of the Canadian Shield. Those with a little streak of larceny will also forget to disclose that these are not new discoveries, and will drill things with already known high grades. These smell of pump & dump schemes. If the company concerned can’t come up with a new innovative approach to explore these gold occurrences they have little business expending shareholder’s money on them.

Also, I know of not one case where a mine has closed having extracted the very last ton of ore. Not many mines close because of low metal prices either, because the major capital infrastructure cost is paid back during the first few years of operation. Unless something catches them unawares, like a huge downward spike in metal prices, or, in the case of some gold miners in the state of Montana, electric power suddenly jumping in price due to deregulation, incremental movements of metal prices don’t force sudden closures. Most mines close because they are exhausted to the extent that there is insufficient ore that is economically extractable. After all, an ore deposit is a finite resource. Often the ore reserve that is left is disconnected in small stopes and not in one coherent block – it is too expensive to get at. Sometimes a reserve is left behind because ground conditions make it extremely hazardous to mine. This is the story for many deep mines that have suffered rock bursts, where under intense pressure at depth the rock suddenly explodes into bits and structurally compromises parts of the mine to an extent that the part becomes off-limits. Commonly, the last area of the mine to be worked is also the deepest, the shallower ore having been depleted earlier. Hoisting ore to the surface is a major cost, but also a huge cost is pumping a mine and keeping it dry. If all the ore that is left is in the deepest part of the mine it stands to reason that all the water that seeps into the workings above will find its way to the lowest point. For instance in Kirkland Lake, mentioned beforehand, the last mine to close, the Macassa, was pumping water seeping into the interconnected workings of seven closed mines, not even under the same ownership.

Many times the only part of a reserve left behind in mining is the “crown pillar” a piece of rock intentionally left that supports the shaft and most of the tunnels. To extract the crown pillar is to permanently end the life of the mine. There are numerous promotions being done at the moment where companies have purchased a defunct mine with a marginal reserve for minimal money to say that they are “leveraged” to the price of gold because the purchase was made for say $10 per ounce. In the case where the site has been restored and infrastructure removed it is highly doubtful that even with a price of gold of $1000 per ounce that certain mines will ever be reopened. Also to bear in mind: the old production record of a mine is never in itself a reason to invest. Mines are finite resources. There’s no point in buying a closed mine unless you already have innovative ideas for finding lots more ore.

With the recent rise in gold prices which caught many in the industry unawares, a number of heavily promoted companies have picked up projects of dubious quality to immediately capitalize on higher metal prices. But there is little new on the scene. In the main, we have just seen the same old projects passed from one pocket to another. How else to capitalize quickly? In Ontario where the Red Lake Mine is, it can take 4 to 6 weeks just to get your provincial land use permit, and woe betide you if you carry out exploration without one. A lot has happened in the gold market in 6 weeks, but in the exploration sense such a time frame is too short to be meaningful.

As I’ve written here before “a rising tide raises all boats”, and the majority of junior miners have appreciated over the last few months. But be prepared to move your portfolio around. If a company keeps presenting at shows but hasn’t actually performed any technical work in months they are to be avoided. As Bob Bishop said at the Vancouver show, most gold investors stay in a specific stock too long. When gold exploration results start to roll in in continuous fashion, we’ll see the wheat separated from the chaff. Companies that make brand new discoveries will zoom ahead of the promotions who are collecting worked-out real estate. In the last week I have heard of companies assembling large and very prospective land positions in El Salvador, Mali, and Tanzania. Some of them already have early indications of new gold deposits. This is the good news I spoke about. It is frontier areas such as these that hold the most promise for finding the huge super-profitable mines of the future.

Greenfields and Blue Skies

Many investors are hesitant to invest in companies that have their projects outside of Canada, the USA or Australia because of perceived “political risk”. To do so is to miss out on numerous frontier plays around the globe, but more than that, in countries where any opponent to a planned mining project can drive a yellow school bus to the nearest university, fill it with students, invite the media, and hold an impromptu environmental protest I would argue that the project risk is identical to operating in Mali, El Salvador or Tanzania – perhaps greater. In recent years we have seen the New World gold project near Yellowstone killed; the McDonald-Seven Up Pete project held up by the anticyanide initiative in Montana (now being challenged in court); the Glamis Imperial Mine in California, in the permitting stage since 1996 finally passed this year only to be held up yet again; and the Voisey’s Bay nickel project finally given the green light after years of wrangling with Aboriginal groups and the Newfoundland government. In Australia, Barrick’s Lake Cowal project has been given a rough ride. Barrick recently dropped the word “Lake” from the name to make it more enviro-friendly. Environmental groups ran ads on television in Toronto for several weeks prior to Barrick’s general annual meeting, calling for a protest rally. Australian explorationists also have known for a couple of decades that new gold discoveries curiously have a habit of transforming into “sacred sites” once the discovery goes public. Sounds like I am being cynical I know, but such is the reality we live in.

My philosophy as an explorationist has always been to “get leveraged” to the price of the metal by finding it – not by buying what someone else has already found, or left behind. I have said in these pages twice before that gold exploration can be as lucrative as cocaine smuggling – and it’s legal! Case in point: Discovery and Geology of the Esquel Low-Sulfidation Epithermal Gold Deposit, Patagonia, Argentina, in the Society of Economic Geologists Special Publication 9 (published 2002).

The Esquel deposit, discovered by Brancote Holdings Plc (about to become part of Meridian Gold Inc.) contains 3.82 million ounces of gold and 6.98 million ounces of silver. The grade is 6.32 g/t gold. The discovery cost per ounce of gold is $3.45 US.

You do the math. Now, that’s how to get leveraged to the price of gold!

The remarkable thing is that the Esquel vein system outcropped (was exposed) on surface! And only 10 kilometres from a town!

The odds of making a discovery such as this in North America are becoming less and less. The only comparable frontier areas are the Northwest Territories and Nunavut in Canada, and Alaska in the USA. The Hope Bay gold system outcrops on surface and contains bonanza-type grades, but it is odd that no one blundered across it before.

The geological edge that Latin America, Southeast Asia and Africa have on Canada is two-fold. Firstly, most of the gold-bearing areas in Canada have been glaciated. When the glaciers tore across the landscape 20,000 or so years ago they removed all vestiges of old tropical weathering profiles, or “oxide resources”. These are the parts of the deposits which have been exposed at and near surface for millions of years and have quietly weathered away so that the sulphide in the rocks has rusted to oxide. Oxide hosted gold is very easily heap-leached, sulphide is not. Heap leach in Canada is also a marginal proposition because of the climate. It has only be carried out seasonally and even then with only limited success because it needs warmth to work properly.

The second strike against Canada is that because of geology it has only limited potential to discover volcanic-related bulk mineable precious metal deposits. These are huge tonnage but low grade deposits like Yanacocha and La Pierina which, due to economies of scale, can be mined at low cost. Underground mining is a much more costly proposition than open pit mining. Goldcorp successfully mines below $100 per ounce costs because the grade of the ore is very high; which mitigates against the high cost of mining a ton of rock.

So, given all the above, even should gold go to $400 or $500 or $600 per ounce, would it seem a better deal to have your operations somewhere where the government will allow you to mine, where you won’t spend all your time fighting environmental lawsuits, and where you have a statistically better chance both of finding world class-sized deposits and deposits that can be mined for under 100 bucks an ounce? Are the majors going to be queuing up to take over the many companies that have amassed “millions of” (high cost) “ounces” in the ground in recent weeks when there will be opportunities to pick up new discoveries with costs <$100/oz, or even find their own?

As my title to this Straight Talk suggests, we are only in Act 1 Scene 1 of the exploration story. There’s a heck of a long way to go, and once companies pick up where the industry left off in 1997, and stick a toe outside of North America, we will see all manner of new and incredibly lucrative discoveries. You can count on it. Canadian companies have been working in self-imposed internal exile because flow-through funding cannot be applied offshore. With higher precious metal prices the industry doesn’t need the crutch of flow-through. Foreign shores beckon.

The goal in investing in a junior gold company is not to find a group which will someday mine a huge deposit – juniors lack mining operational expertise by definition, and rarely could ever go to the bank to raise the capital necessary for mining their own gold. Your objective should be to find companies that are most likely to be taken over some day by a major – something that Newmont and Barrick will pay top dollar for. Don’t take your eye off the ball.

Bullish Days for Silver

At the risk of being accused of long-windedness I want to say a bit about silver and some interesting developments. (Since I haven’t written in awhile I owe you an extralong Straight Talk). Firstly though, I want to relate a bit of history I found today. When dealing with mining one should always be aware of the time-lag between making a viable discovery and getting a mine into production. The absolute minimum for a hard rock mine is about 2.5 years. Most take 3 or 4, some a decade. The larger companies try to forecast 2, 5, 10 even 20 years into the future. They tailor their exploration programmes to these forecasts. They can’t easily react to changing circumstances. You can think of the mining industry as a great big Exxon Valdez supertanker – if there is trouble ahead you need a lot of room to change course or else you’ll collide. The simplest way to get out of trouble should you find yourself suddenly needing gold or silver reserves is to buy them. But what if there’s nothing to buy?

Here’s the history bit:

From Peru Report’s Las Minas del Peru (The Mines of Peru), written by Johnathan Cavanagh, 1991:

“In Peru, up to the early eighties, the backbone of Peru’s national private mining economy was silver and its premier mining companies were those with impressive silver production. The small mine sector survived on silver output, and among the polymetallic producers, silver production provided the real gravy in bottom-line economic results.

……However silver dependant companies were facing a fatal combination of Peru – specific economic disasters plus no foreseeable change in chronically low world silver prices.

Today the silver companies are scrambling to maximize output of any paying mineral besides silver. Nearly a third of Orcopampa’s sales now come from gold. Arcata has installed zinc and lead flotation circuits that came on stream in 1989, initiating production of zinc and lead concentrates and resulting in 1990 in a tenfold increase in zinc output and lead over 1989 output…. Even the companies which can make a transition are having to struggle to survive, but a number of mining companies, some with long and proud histories, are nearing extinction.

Most silver production is associated with zinc and lead mineralization. Often it accompanies copper or gold. As economic values of copper, zinc, lead or gold, or a contribution of these, become attractive to miners, the production of silver, like lead, rises independently of its theoretical demand. This creates a situation of oversupply, forcing low prices. World prices averaged as high as US$10 to $11 per ounce as late as 1983; since then the average has been US$6.25/oz although this average masks 1989’s US$5.60 and 1990’s US$4.83 yearly averages. Prices were often less than US$4.00 during the first months of 1991.

The decade-long upward trend in worldwide silver production, in contrast to the downward spiral in world silver prices is the result of expanded production in copper, zinc and gold, especially the explosion in gold output resulting from widespread use of heap leaching technologies allowing exploitation of low-grade precious metal deposits. The resulting joint output of silver had flooded world markets just as demand for silver has remained static.

The prolonged low price is also leading to a change in the public perception as to silver’s intrinsic value. Even though its use in adornment has not withered, its relative value to other precious metals, principally gold, has diminished. This lessening of the value in the public eye in the long run can contribute to resistance in pricing beyond the industrial value of silver in the world marketplace. This fall from preeminence of silver, as a store of value in and of itself, through the centuries and up until only a decade ago, is a latent danger for the world silver fraternity.

However, these concerns are esoteric to the mining executive in Peru trying to save his operation from closure. Even in the absence of the economic policies detrimental to exports of the past few years, the prolonged plunge in world silver price due to increased production far beyond market demand, would probably have led to similar results”. END

Sounds pretty grim, right? This was the story in 1991. Peru is one of the historically biggest producers and most prospective countries on Earth for silver deposits. We all know that the silver price has been in the doldrums until recently, though there was a brief spike in spring 1998 due to the Buffett buying. The price of silver has not improved dramatically since 1991, and silver exploration in Peru – with some notable exceptions – has been a non-starter. Silver producers went to the wall, got out of projects where silver predominated and got into polymetallics, or, as Cavanagh suggests, threw in the towel and got out of the silver business altogether

What Mr. Cavanagh fails to mention is that worldwide silver demand in 1991 actually outstripped supply, and that the deficit was made up by sales from stockpiles, notably that of the USA.

Eleven years on what has changed? Cavanagh was extremely pessimistic about the future for silver. Why am I bullish?

From St. John’s Telegram, January 8th, 2002.

TORONTO – Mining analysts expect base-metal prices will begin to recover later this year after a disastrous 2001 that saw copper and zinc reach their lowest levels in more than a decade.

However, TD Securities Inc. cautions that ”it is difficult to foresee a bullish scenario for metal prices in the absence of a return to strong economic growth in 2002.” TD Securities does not expect a meaningful protracted recovery to begin until the second half of 2002.

Copper closed Friday at 65.8 cents US per pound on the London Metal Exchange after hitting a 14-year low of 59.7 cents a pound in November. In late 2000, copper traded at 86 cents a pound, before the global slowdown reduced demand for copper wire and pipe.

One of the worst-hit metals, zinc, closed at 36.7 cents a pound, slightly above its 15- year low of 33.5 cents a pound a month ago. In September 2000, zinc traded at a threeyear high of 57 cents a pound.

The low zinc price reflects worldwide weakness in steel markets. Zinc is used to make galvanized steel and by the automotive industry for car parts.

Nevertheless, AME Mineral Economics has a positive outlook for zinc, saying that as mines and smelters are closed and the U.S. economy recovers in late 2002, market sentiment will turn around and prices will lift to average 42 cents a pound through 2002. END

Get the picture? Base metal mines and smelters are closing because of weak prices, this means that by-product silver production will drop. As the recession deepens the demand for base metals will weaken with declines in manufacturing. Since most of the world’s silver now comes as a by-product of base metals, any drop in base metal production, especially zinc, will decrease the supply of newly-mined silver. Most companies got out of primary silver mining in the 1980’s and early 1990’s. Does this suggest a squeeze in supply is coming?

Here’s an interesting tidbit as well:

From the Financial Times, June 14, 2002.

Market takes stock of molybdenum rally

Molybdenum prices have stabilised in recent days as the European market takes stock of a rally that sent prices soaring to their highest since 1995 based on tight supply and steady demand.

Production cuts and curtailments at major copper producers in North and South America and reduced Chinese exports have affected molybdenum, a by-product metal. Molybdenum’s main use is as an alloying addition to enhance strength, hardness, and corrosion resistance in alloy and stainless steel.

“To produce one more unit of moly to sell at $8.00 a pound they’d [copper miners] have to produce 10 more units of copper at a fairly poor price. It’s not going to happen,” said a trader. END

The last sentence I couldn’t have said better myself. In fact, I did say it, as it applies to silver, in Straight Talk #8 (take a look on my website). Base metal producers won’t ramp up production if the silver price rises. The moly supply is clearly being squeezed – if the silver market was more transparent we’d probably see similar behaviour.

and then we throw these last three items into the pot:

From the Northern Miner June 10, 2002.

Global silver supply fell 6% in 2001. The drop was recorded despite a modest 1.5% increase in mine production. The increase in mine production resulted from growth at several base metals operations, particularly in Peru and Chile, where silver is produced as a byproduct. Of note, material from primary operations generated 25% of total mined silver last year. Mexico again mined the most, followed by Peru, Australia, the U.S. and China.

As for 2002, the weak outlook for base metals prices — coupled with the implementation of numerous production cutbacks at zinc and copper operations, and reduced silver byproduct from gold mines in 2001 — suggest lower silver output.

and……..

http://www.usmint.gov/downloads/foia/pef02Q1.pdf

American Eagle Bullion Coin Program and Stockpile Silver

Since the beginning of the American Eagle Silver Bullion Coin Program in 1986, the Mint, through an interagency agreement with the Defense Logistics Agency (DLA), has been using the Strategic and Critical Materials Stockpile as the source of silver as mandated by the program’s enacting legislation. Sales of American Eagle Silver Bullion Coins continued to be strong in the first quarter of FY 2002, generating revenues of $11 million. A program milestone reached on December 27, 2001, with an order pushing the program total (since 1986) to 100,000,000 Silver Eagles sold.

American Eagle Silver Bullion Coins continue to dominate both the domestic and global markets, outselling its nearest competitor by a nearly 10 to 1 margin. This strength in the marketplace is rapidly depleting the silver stockpile. Based on current sales projections, plus current inventory of blanks, there is enough silver in the DLA stockpile to cover through the first quarter FY 2003 (end of calendar year 2002). If a technical amendment to the program’s enacting legislation is not approved before then, the Mint would be required to shutdown the program when DLA silver is depleted. In order to continue the program, the Mint is proposing an amendment that will allow the Secretary to obtain silver from any other available source as a stockpile depletion contingency, similar to the bullion source provisions in commemorative coin legislation. This language was provided to Congress last quarter for consideration.

and lastly, http://minerals.usgs.gov/minerals/pubs/commodity/silver/880302.pdf

“The Defense Logistics Agency (DLA) delivered all of the remaining 467 tons of silver in the National Defense Stockpile to the US Mint for use in its coinage program. Under an agreement with the U.S. Treasury Department the metal will continue to be carried as DLA stocks until the metal is consumed by the mint. The transfer marked the end of the silver stockpile era.”

These are different times from 1991. It’s all shaping up in 2002 to be one humdinger of a silver supply squeeze, especially as investor demand picks up. And, like I said at the beginning of this section, the Exxon Valdez silver supply is headed for the rocks – the wheel is “hard-a-port” – but it looks like it’s too late to do anything about it now.

Straight Talk On Mining Insights on mining from economic geologist Dr. Keith Barron.

Straight Talk On Mining Insights on mining from economic geologist Dr. Keith Barron.