The Gold Share Market Entering a Second Phase

In the past week the Canadian national newspaper, the National Post, had a special insert on Mutual Funds:

the Precious Metals Fund category average one-year return as of March 31st was 68.49%, the highest of any mutual fund category.

Under the caption “best performers”:

for one month: 3 of 10 are gold funds

for six months: 4 of 10 are gold funds

for year to date: 8 of 10 are gold funds

for one year: 8 of 10 are gold funds

In BusinessWeek magazine, April 8, 2002: In a table entitled “The Best Funds”, a full twenty of the top thirty best performing mutual funds are precious-metal funds.

And yet, if you were to glean all your investment advice from the telly, you’d hardly know this has happened. If you were to “stay the course” and had stayed in tech for the last year as exhorted by a constant parade of “analysts” on the boob tube you would have missed out on this tremendous run…in fact many of your share certificates might be expensive wallpaper now.

Back on August 20th, 2001, in an essay entitled “The Gold Moonshot”, I wrote:

“Imagine, the investing public mobilised behind the NEXT big thing! Imagine what would happen if the gold market became the only game in town! Imagine the profits to be made in the next penny stock company to make a colossal gold find! There are junior companies out there beginning to explore again. There are new opportunities. All we need is the proverbial spark to make this market catch fire. With share prices of gold producers on the rise, it is only a matter of time before we see new junior companies sprouting up everywhere and a healthy exploration scene restored.”

The gold market is the only game in town. There is no other sector out there yielding comparable returns.

It has been 8 months now since I wrote “The Gold Moonshot”. Now every time the anti-gold forces play whack-a-mole with the price, and force gold under the magical $300 US level, it is rightfully seen as a buying opportunity and investors around the world, particularly in Asia, gleefully cash in their greenbacks for bullion. We just saw this happen again.

Despite the hype and the hoopla, and massive injections of liquidity, the “zero interest” rates on houses, furniture and cars, the American economy has not spectacularly rebounded. The U.S. dollar ought to be pinned to the mat, under the crushing weight of the trade imbalance, and yet, it continues to defy gravity, but only at the acquiescence of the Asians and the Europeans whose favours could be withdrawn at any time. The trade deficit, like the Gold Carry Trade, is unsustainable and of finite life. It is the “second shoe” to drop. Once the “mighty” dollar starts to head South we are due for a massive rise in the gold price. The latest figures show that the trade deficit has swollen to a massive $31.5 billion.

A big question is, when all these bullish factors kick in for gold will we see gold shares rise like tech shares did four years ago? Could we see gold shares go to $100 a piece? Could merely the word “gold” in a company name be a ticket to riches much like “com” was? Could we see marigolds and golden retrievers go through the roof?

I wouldn’t go out and corner the flower and dog markets just yet……. Gold still seems to be capped at the $301-$302 range, though in the last week or two we have seen many analysts concede that $320 is an achievable number in the short term. My own opinion is that we won’t see massive moves in the gold market until it captures the public’s imagination, and we see people moving their entire 401K into gold shares or taking out third mortgages to buy bullion. Recently an analyst at a major international gathering had this sobering statistic: the entire worldwide market capitalization of the entire worldwide mining industry (gold, silver, base metals, industrial minerals) is less than McDonald’s Restaurants. This is part of the reason why it doesn’t get covered minute-by-minute on Bubblevision – the market is too small – but once-upon-a-time the internet start-up market was small as well…..

The newswires have been reporting that until mid-May we will be able to see Jupiter, Mars, Mercury, Saturn and Venus at the same time from Earth, a phenomenon that only comes around every 20 years or so. Are the planets similarly aligned for gold? We don’t often see a conjunction of bullish gold news such as we have now. For a start, the escalating unrest in the Middle East, a potential for more violence in Venezuela, higher oil prices, an admission from Gold Fields that the HIV/AIDS epidemic will add up to $10 an ounce in extra production costs raising awareness of the impact of the pandemic, warnings from AngloGold chief executive Bobby Godsell and Gold Fields chief executive Chris Thompson that supplies of newly-mined gold are to drop and that ounces can’t be replaced by the industry at current prices, and a survey by Beacon Group Advisors that warned that supplies would plummet by nearly 30 percent by the end of the decade unless prices rise from current levels. Perhaps the most compelling reason to switch your portfolio into gold shares, or at least take a greater weighting, are the persistent credit concerns and accounting scandals which continue to come to light on a weekly, if not daily basis from the broad market, including the bluest of blue chips. The cupidity and duplicity of company officers and insiders, aided and abetted by analysts, lenders, accountants, auditors, regulators and Bubblevision is astounding. Surely the knock-on effect of these scandals must have far greater consequences than the scandals themselves.

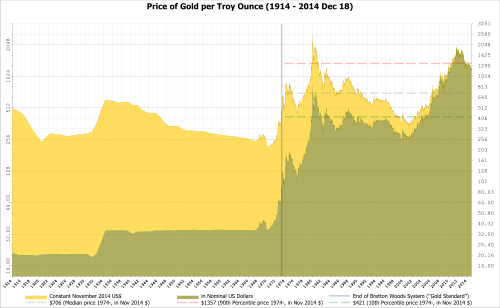

The gold market is now entering a second and predictable phase. Initially, the gold shares rose in anticipation of higher gold prices; it hasn’t really happened yet. Higher bullion prices too are inevitable, but forecasting the precise timing is near impossible. The bullion price has only experienced modest gains in the last 8 months – not the $400, $500 or even $600 price per ounce augured by many gold bugs as the “rightful” price. If we saw a 68.49% increase in the bullion price from March 31st 2001, gold ought to be at $435 US. Instead, the gold price lags behind gold shares. Who would have predicted such massive gains in gold shares without massive rises in the bullion price? Only the delusional still suggest that we will ever return to a gold price of $250, below the costs of most world production, and so the downside risk for gold is minimal and the upside….well, the sky’s the limit. Savvy investors realize this and systemic risks in the broad market are making them shift money into gold. This is the major reason for the growth in the gold share market. The beginning of the second phase is marked by a temporary shrinking in quality investment opportunities in the gold sector, due to mergers and acquisitions. I also mean the diminishing chance of multiplying your money several hundred percent in a gold producer (unless gold prices rapidly and substantially rise) as share prices climb and start to plateau. Once the golden metal began to shine again and companies could raise the bucks, they went shopping. We all of course know about the acquiring of Battle Mountain by Newmont, the merger of Barrick with Homestake, and the three-way merger of Normandy, Newmont and Franco-Nevada, but these are all big gold producers. If companies want to grow, they better hustle and secure the few quality projects in an advanced stage of exploration that are still out there. In recent weeks we have seen Pacific Rim Mining merge with Dayton Mining, Francisco Gold snapped up by Glamis, and Brancote Holdings merged with Meridian Gold.

Pacific Rim owned the Diablillos silver-gold project in Argentina which it sold to Silver Standard. The cash-rich company then hitched up with Dayton Mining on the strength of Dayton’s El Dorado gold-silver project in El Salvador.

Francisco Gold’s El Sauzal project in Mexico contains an oxide gold reserve of 20.9 million tonnes grading 3 grams gold per tonne, equivalent to 2 million contained ounces. This material has been deemed mineable by open-pit methods. They will spin-off their Guatemalan Marlin project into a Newco.

Brancote has been exploring the near-surface high grade Esquel project in Argentina for several years. They’ve now found 15 veins over a distance of 20 kilometres and have calculated a measured, indicated and inferred resource of 3.8 million oz. gold and 6.9 million oz. silver in 19.3 million tonnes grading 6.06 grams gold and 11.1 grams silver, based on a cutoff grade of 1 gram gold per tonne. What a great project!

On the www.MiningWeb.com : “Gold supply crisis looming – Gold Fields.” Gold Field’s Chief Executive, Chris Thompson spoke of looming massive structural problems in mine supply. Those who have been reading Straight Talk for some months have heard me talk about this problem in almost every essay. I haven’t been “Crying Wolf”.

Let me put it this way: the tech “boom” and Bre-X “bust” compounded together to internationally seize-up the mechanism that generates new gold projects – a situation not experienced since 1939-45 when the world was at war (during the war of course base metals exploration and production was fast-tracked for the war effort). By 1998, virtually all gold exploration worldwide came to a sudden and complete halt, as the venture seed capital which would normally go into junior exploration was voraciously gobbled up by tech and internet start-ups. We have had slow downs in the gold mining exploration sector many times over the last century, but never a total abandonment and decimation of the sector. Those of us who work down in the trenches realize how dire the situation really is – how many of our colleagues have dropped out of exploration and are now in other professions, and how few have been able to weather the storm of unemployment or underemployment over the last 5 years. If you were a public-listed exploration company and have survived from 1996 to the present, the chances that you have been carrying out grassroots exploration and generating new projects is just about nil. You have been in cashconservancy mode and have hung on by your fingernails. In the heady days of 1994-95, many juniors gave generous terms to landowners in option agreements for their mineral rights. Option agreements usually have staged payments over 3, 4 or 5 years. Front end payments are usually nominal, but by year 4 or 5 when a company would normally know through exploration just what was shaping up in the ground in terms of resources, payments are often in the hundreds of thousands or millions of dollars. I know plenty of juniors who fought hard to scrape together the cash just to hold their properties from year to year, leaving nothing for exploration expenditures. Unless they renegotiated their agreements they were pretty much done, because no one foresaw the depth or length of the sector downturn. The junior mining scene has always been the incubator for most new mining projects, but fertile ground was made sterile.

In light of all this we have a curious and historically unprecedented situation in the gold sector. There are virtually no new projects in the pipeline. By new projects I mean new discoveries made in the last 3 years. And yet companies are raising substantial money for the first time in years. Let’s have a look at 10 major recent financings and make an educated guess as to where the cash is to be spent:

- Agnico-Eagle raised US$144 million via a convertible debenture (expansion programme at La Ronde mine)

- Cambior (CDN$28 million) (finalized feasibility study for Gross Rosebel, exploration will focus on mine sites)

- Eldorado Gold (CDN$25 million) (São Bento drilling, nearby Brumal project drilling, take Kisladag to feasibility)

- High River Gold (CDN$10 million) (increased interest in Buryatzoloto, their Russian mining partner)

- Ivanhoe Mines (CDN$57 million) (Turquoise Hill drilling, comprehensive reconnaissance programme, South Gobi)

- Kinross Gold (CDN$31 million) (joint venture in Timmins area with Placer, potential reopening of Pamour)

- Northgate Explorations (CDN$45.4 million) (Kemess North project development)

- Pan American Silver (CDN$22.2 million) (expansion of La Colorado silver mine in Mexico)

- TVX Gold (CDN$75 million) (unspecified, though the company has several advanced projects)

- Minefinders (CDN$10.1 million) take Dolores silver-gold project to feasibility

It’s of course impossible to know precisely the plans of each company, but only Ivanhoe has stated that a good chunk will go towards grassroots reconnaissance. The Ivanhoe story may be new to many investors, but the Turquoise Hill discovery is not new; in fact there was a scholarly scientific journal article published about it by BHP staffers recently. The other companies listed above will spend bucks on exploration working around their existing minesites. AngloGold and Newmont have recently become involved in the Red Lake gold camp in northwestern Ontario. Everyone knows the Goldcorp story of course. Goldcorp is merely pulling the type of mineralization out of the ground that Placer Dome’s adjacent Campbell Red Lake Mine has been mining for years, and in fact the high grade zones were known a few years back before Goldcorp’s miners strike. The Red Lake camp has been intensively explored since 1925 and is swiss-cheesed with drill holes. Does anyone seriously believe that a world-class discovery still sits there waiting to be discovered? Or does the success of Rob McEwen, Goldcorp’s president, mean that from a corporate standpoint a major has to be involved there?

Companies are being highly conservative. Of course bringing a gold deposit into production is a noble goal (pardon the pun), but will increasing the reserves of an orebody by 5% mean a 50% increase in your share price? Somehow saying in a press release that you have just raised $3 million for underground development and refurbishment doesn’t catch the imagination in the same way as a sexy drill hole on a brand new discovery. Investing in a company that is in the development stage is like buying a company that pays dividends – you probably won’t lose, but you’re not going to make 500% on your money in a few weeks either. There are virtually no new discoveries out there. The only stories in the last few months have been Turquoise Hill by Ivanhoe and an Olympic Dam-type discovery by Australian junior Minotaur. Neither is a pure gold play.

One gets the feeling that the reasons for the recent mergers and acquisitions, and the flurry by junior and mid-tier companies to get feasibility studies completed, is to get on the various radars of the funds. We hear the buzz phrase “leveraged to the price of gold” everywhere, but for many companies currently holding uneconomic orebodies a higher gold price won’t mean a substantial return on investment in a mining scenario unless the gold price doubles. Critics call this the “game of ounces for ounce’s sake”, and it almost sounds like a New Era stunt. Forget all the propaganda about “synergies” etc., we have just gone through a phase in the business world where the “biggest” attracts the most investment. Doesn’t seem to matter if they are profitable or not, just as long as they have a big capitalization. Gold projects that are of the best quality almost never are allowed to get anywhere near feasibility studies before they are bought or taken over by a major. Having ounces in the ground does not necessarily mean having economic ounces in the ground – there are few projects out there that are going to yield any return on investment unless the bullion price goes above and stays above $US400.

There’s a saying that “a rising tide lifts all boats”. Practically every gold company has appreciated in value over the last year, including the dogs. In a buoyant market even the dogs do better, and there are a number of mutts out there. Dogs can be identified readily because they are usually touting a subeconomic property that they have had for years and have done virtually nothing with, or, they go back and drill a hole or two every year without coming up with an orebody. In the industry we call these projects “tired old wh—s” (rhymes with doors) because they have been shopped around everywhere. It’s important when you do your due diligence on a company to find out what the history of a project is. Unless a land package is huge and just takes time to work through it shouldn’t take a company more than a few seasons of diligent work to understand if it is worthwhile or not. A company that has already made a discovery should be growing ounces through drilling and other exploration. The Goldcorp story of taking an old mine and turning it into a high-grade producer is highly unusual and rare.

My own evidence tells me that the exploration scene is not yet back. I sent some samples to the assay lab the other day and it was dead….they started on my samples that afternoon. Normally, I’d have to wait days or weeks. Also, yesterday I visited a company that provides field supplies and was told that practically nothing was being sold to “mining guys” but plenty to forestry.

In the next few months though I predict we will start to see a third phase in the gold market, which will be an explosion in new listings and IPO’s. There is always a time-lag before this happens, after the market starts to turn around. In former times there have always been a few companies out there providing the odd bit of news to keep the penny stock market interesting. The penny stocks are typically pure exploration plays…high risk but potentially high reward as well, and to get in the game is a minimal investment. We’ve seen them pass away over the last few years, but it’s a sure bet that they’ll be back. It’s usually a new discovery by a junior that kicks off a bull market in gold shares. This bull market is odd because it hasn’t been sparked by a new discovery. In Canada, the juniors are already leaping again into diamond exploration, but not yet into gold.

There was a fair bit of media coverage of the Australian Gold Conference in Melbourne last week, but the annual meeting of the Society of Economic Geologists in Denver went ignored, though there were plenty of interesting topics discussed. Doug Silver of Balfour Holdings gave a talk entitled, “Future Exploration Success.” Some important points:

- there have been 600 major mineral discoveries over the last 20 years, and none in the last two

- between 2000 and 2001 50% of gold companies decreased production.

- $200 million US has been raised for gold companies since January of this year

He also gave some interesting wealth-creation statistics. The juniors that found Lisheen (lead-zinc mine in Ireland), La Pierina (gold in Peru) and Voisey’s Bay (nickel in Labrador, Canada) each spent respectively $9.5 million, $18.3 million and $19 million on exploration before they were acquired by majors. The projects were sold for $140 million, $765 million and $2.377 billion; to give a wealth-creation multiple of 15:1, 42:1 and 124:1. This is what has driven the exploration game in the past, and will continue to induce speculators to invest in the future.

Adrian Day of Global Strategic Management said recently, “Exploration is very risky; we know that. The odds are not quite as bad as the Big Game Lottery, but not far off.” I wouldn’t disagree with this, but I think the statement needs to be qualified by saying that some individuals – both promoters and geologists – have shown remarkable talent over the years for picking winners and finding economic orebodies again and again. It’s not a crap shoot if you choose your investments wisely. The majority of money raised for exploration in a bull market is wasted – always has been, always will be, because mining booms by their very nature attract a lot of peripheral players, and the odd kibitzer or two. If we added together all the companies that had land in the Helmo area, the Lac de Gras area, and the Voisey’s Bay area when each experienced their staking rushes we’d probably have several thousand companies, only 10 or so of which made money. It’s the nature of the beast. You should bear this in mind when you read articles that say exploration is an “extraordinarily unprofitable venture”. You might be feeling then somewhat bewildered as to what constitutes a good junior company and a good discovery, and maybe a little dismayed that you can ever pick winners early. In the next few weeks Straight Talk will present a series of essays that will take some of the voodoo out of stock picking.

Get prepared for the next round of new gold discoveries, because, with the market set-up the way it is there is no telling what could happen. We’ll see major companies leap into exploration when it becomes too expensive to grow by acquisition, and juniors, when they realize that they can once again gain a following and raise money. The recent run of the gold shares has only been a preliminary for the main event. When a company finds the next new discovery with potential for production costs under $100 per ounce we’ll see this market really run.

I have had a number of E-mails over the last few weeks asking what I was up to. Like any good entrepreneurial geologist who knows something about gold I have been off in the tropics finding some, for my own account, and filing paperwork on new gold concessions. This to my mind is a no-brainer. “Gotta be in it to win it!”, as they say. In the next Straight Talk I’ll talk about the exploration process, starting with land selection, and give you a few of my personal insights as well.

Straight Talk On Mining Insights on mining from economic geologist Dr. Keith Barron.

Straight Talk On Mining Insights on mining from economic geologist Dr. Keith Barron.